What Is the Affordable Care Act (ACA)?

Require most U.S. citizens and legal residents to have health insurance. Create state-based Health Benefit Exchanges through which individuals can purchase coverage, with premium and cost-sharing credits available to individuals/families with income between 133-400% of the federal poverty level and create separate Exchanges through which small businesses can purchase coverage. Require employers to pay penalties for employees who receive tax credits for health insurance through an Exchange, with exceptions for small employers. Impose new regulations on health plans in the Exchanges and in the individual and small group markets. Expand Medicaid to 133% of the federal poverty level.

Require most U.S. citizens and legal residents to have health insurance. Create state-based Health Benefit Exchanges through which individuals can purchase coverage, with premium and cost-sharing credits available to individuals/families with income between 133-400% of the federal poverty level and create separate Exchanges through which small businesses can purchase coverage. Require employers to pay penalties for employees who receive tax credits for health insurance through an Exchange, with exceptions for small employers. Impose new regulations on health plans in the Exchanges and in the individual and small group markets. Expand Medicaid to 133% of the federal poverty level.

Healthcare Reform For Employers

If you offer coverage what must be included (all size groups)?

If you do provide insurance, make sure your health plan meets these new requirements:

Is adequate and affordable:

Insurance is considered “inadequate” if it pays less than 60% of health care expenses for a typical population and “unaffordable” if employees have to pay more than 9.61% of their income to buy it.*

- Does not exclude people with pre-existing medical conditions.

- Does not put annual or lifetime limits on coverage.

- Does not allow coverage to be canceled solely because of an honest mistake an employee made on the insurance application.

- Does not make new employees wait more than 90 days for coverage.

- Provides coverage for employees’ adult children up to age 26.

- Provides essential benefits,* including:

- Ambulatory patient services

- Emergency services

- Hospitalization

- Maternity and newborn care

- Mental health and substance use disorder services, including behavioral health treatment

- Prescription drugs

- Rehabilitative and habilitative services and devices

- Laboratory services

- Preventive and wellness services and chronic disease management

- Pediatric services, including oral and vision care

- Allows children to use a pediatrician as their primary care provider.*

- Allows women to use an ob-gyn as their primary care provider.*

- Allows patients to receive emergency care at a non-network hospital without preauthorization and without paying a higher copay or coinsurance.*

- Limits annual cost-sharing to the caps on high-deductible plans linked to health savings accounts. Currently for 2016, those limits are $6,850 per year for individuals and $13,700 per year for families.*

- Provides required preventive care with no copay.*

*Requirements don’t apply to grandfathered plans — those that were in effect on March 23, 2010, and have not changed substantially.

Definition of a Small Group?

If you have 50 or fewer full-time equivalent (FTE) employees you’re considered a small business under the health care law for 2016.

What do small groups need to know?

If you have fewer than 50 full-time employees (or an equivalent number of part-time employees), you don’t have to provide insurance. If you’d like to offer coverage, you can buy it through a private insurer or through the insurance marketplace (SHOP Exchange)

Determining if you are a larger employer.

For each calendar month of the preceding calendar year, employers must:

- Count the number of full-time employees (including seasonal employees) who work an average 30 hours per week per month.

- Calculate the number of full-time equivalent employees by aggregating the number of hours worked by non-full-time employees (including seasonal employees) and dividing by 120.

- Add the number of full-time employees and full-time equivalents calculated in steps (1) and (2) for each of the 12 months in the preceding calendar year.

- Add the monthly totals and divide by 12. If the average exceeds 50 full-time equivalents, determine whether the seasonal employee exception applies.

Seasonal employee exception:

IRC §4980H does not apply to employers whose workforce exceeds 50 full-time employees for no more than 120 days, or four calendar months, during a calendar year if the employees in excess of 50 who were employed during that period were seasonal employees. The 120 days or four calendar months are not required to be consecutive.

Seasonal workers are workers who perform labor or services on a seasonal basis, as defined by the Secretary of Labor, and include retail workers employed exclusively during holiday seasons. For this purpose, employers may apply a reasonable, good faith interpretation of the term “seasonal worker.” 29 CFR 500.20(s)(1).

Businesses with more than 50 employees – Employer Mandate

If you have the full-time equivalent of 50 or more employees, you must provide affordable health insurance for anyone working over 30 hours a week, or pay a fee. The two penalties are below:

Tax for no coverage 2020 – IRC §4980H(a)

- If a large employer does not offer minimum essential coverage to full-time employees and their dependent, an employer may face a tax of:

- $2,570 x the total number of full-time employees (FTE) if at least one FTE is receiving a premium assistance tax credit.

Large employers who do not offer coverage may subtract the first 30 workers when calculating their liability for taxes under IRC §4980H(a)

Tax for unaffordable coverage 2020 – IRC §4980H(b)

- If a large employer offers minimum essential coverage to full-time employees and their dependents but the coverage is unaffordable to certain employees or does not provide minimum value, and employer may face a tax of:

- The lesser of $3,860 x the number of FTEs receiving a premium assistance tax credit or $2,570 x the total number of FTEs (minus first 30)

Taxes under §4980H(b) are capped not to exceed an employer’s potential tax under §4980H(a).

In addition to adequacy and affordability requirements, you need to make sure your plan:

- Does not exclude people with pre-existing medical conditions

- Does not put annual or lifetime limits on coverage

- Does not make new employees wait more than 90 days for coverage

- Provides coverage for the employees’ adult children up to age 26

View our presentation on The Affordable Care Act: Summary of Proposed Employer Rules

ACA Compliance

Employer Mandate Reporting (for groups with 50 or more FTE employees)

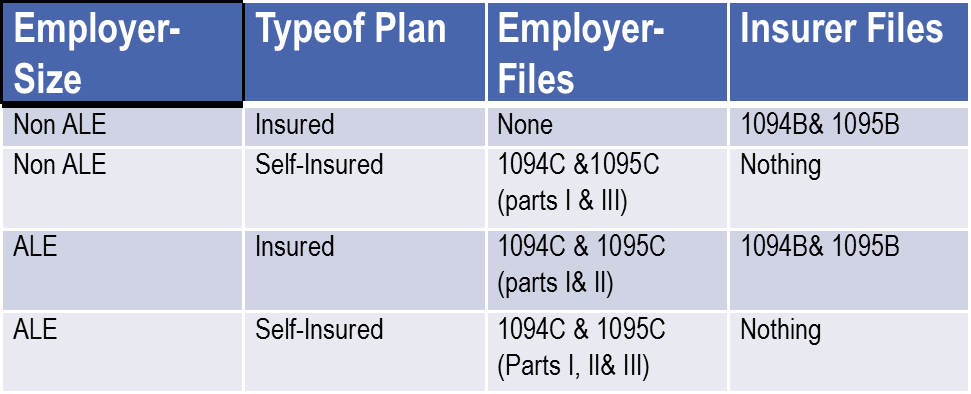

In March 2014, final regulations were issued regarding the employer reporting requirements imposed by the Affordable Care Act. There are two types of reporting which will be required

- Section 6055 reporting (Individual Mandate reporting) applies to insurers and self-insured plans

- Section 6056 reporting (Employer Mandate reporting) applies to Applicable Large Employers

ALE = at least 50 full-time equivalent employees during prior year

Please view our webinar for details on the reporting.

Employee notification

Employers must provide all employees with an Exchange Notice prior to October 1, 2014. There are two versions depending on whether you offer group coverage. The notice informs them of the following:

- They can purchase health insurance through state marketplaces.

- They may be eligible for subsidies to pay for it.

- If they do buy insurance from a marketplace, they might receive no contribution from the employer to pay for it.

Summary of Benefits and Coverage (all groups that offer coverage)

Employers are also required to provide to all eligible employees with a standard “Summary of Benefits and Coverage” form explaining what their plan covers and what it costs. The required timing for distribution is as follows:

- The Summary of Benefits and Coverage must be provided when an employee requests information about a plan, applies for coverage or enrolls in a plan.

- If any benefit changes are made before the coverage becomes effective, updated information must be provided.

- The Summary of Benefits and Coverage must be provided within 60 days after an individual enrolls due to a special enrollment event.

- During annual enrollment, an individual must receive a Summary of Benefits and Coverage for the plan in which he or she is enrolled. Summaries for other available plans must be provided upon request.

- When an employee requests a Summary of Benefits and Coverage, it must be provided within seven business days.

W-2 Reporting

The W-2 reporting requirement is something that’s required of all businesses that offer an employer-sponsored health plans. This requirement began in 2012. Employers must report the costs of the health benefits to the IRS on their employee’s W-2 Form. This is for reporting purpose only and does not mean that the coverage is taxable.

For employers who filed fewer than 250 W-2 forms there is transition relief from the requirement to report the value of coverage on the 2012 Forms W-2 (the forms for calendar year 2012 that employers generally are required to provide employees in January 2013). This relief will apply to future calendar years until the IRS publishes additional guidance. However, any guidance that expands the reporting requirements will apply only to calendar years that start at least six months after the guidance is issued.

Wellness Incentives

The law allows businesses to offer greater wellness incentives. Businesses can offer discounts of up to 30% off insurance premiums to employees who take part in employer-sponsored wellness programs. This is an increase from the 20% discount previously allowed.

Fees and Taxes

- Tax on Insurance companies (beginning 1/1/14). Beginning at 1.9% -2.3% of premiums, growing to 3-4% by 2023. Impacting insured renewals after 1/1/13.

- Fees to support Exchanges. Federally Facilitated Exchanges will include a fee of about 3.5%. States running their own exchanges will assess fees as necessary to support the exchange.

Resources